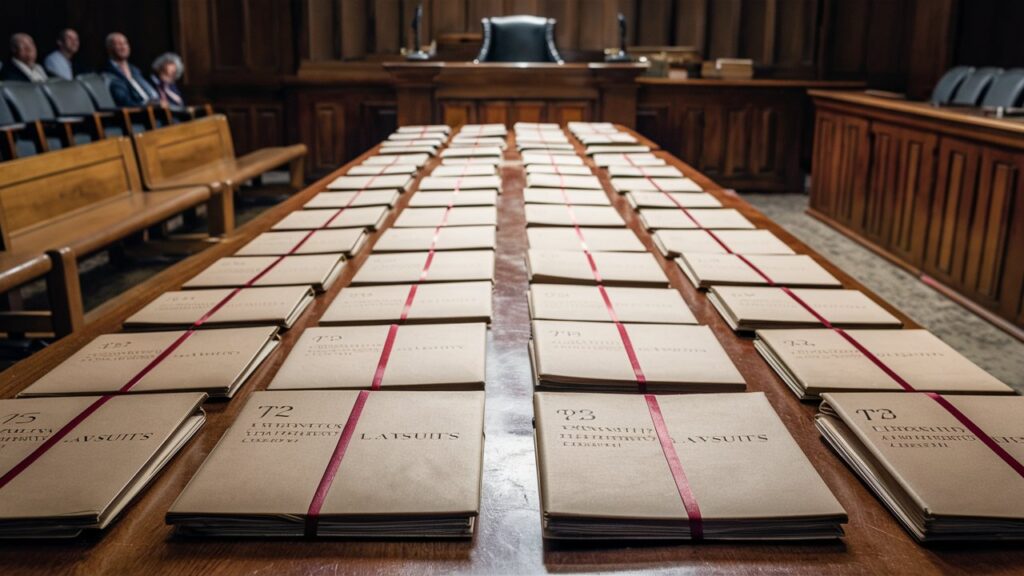

The real estate industry is no stranger to controversy, but the 72 Sold lawsuit has captured significant attention, raising critical questions about ethics, transparency, and consumer protection. 72 Sold, a tech-driven real estate platform promising rapid home sales, now faces legal scrutiny over allegations of deceptive practices, breach of contract, and financial mismanagement. This article dives deep into the lawsuit’s origins, the implications for homeowners and agents, and the broader lessons for the real estate sector. By exploring the key allegations, stakeholder reactions, and ongoing legal proceedings, we aim to provide a comprehensive understanding of this pivotal case and its potential to reshape industry standards.

Understanding the 72 Sold Business Model

72 Sold emerged as a disruptive force in real estate, marketing itself as a platform that could sell homes in 72 hours through aggressive digital marketing and a network of pre-qualified buyers. The company claimed to leverage proprietary algorithms and a vast agent network to streamline sales, often guaranteeing competitive offers. However, critics argue that the platform’s promises were overly optimistic, with some clients reporting delayed sales, hidden fees, and pressure to accept lowball offers. This section examines how 72 Sold’s business model—centered on speed and convenience—may have contributed to the legal challenges it now faces, including allegations of prioritizing volume over client satisfaction.

Core Allegations in the 72 Sold Lawsuit

The lawsuit against 72 Sold, filed by a coalition of homeowners and real estate agents, centers on four primary allegations:

- Deceptive Marketing Practices: Plaintiffs claim the company misled clients by exaggerating success rates and downplaying risks, such as the likelihood of homes selling below market value.

- Breach of Contract: Homeowners allege that 72 Sold failed to honor contractual obligations, including promised timelines and guaranteed offers, leaving them financially stranded.

- Hidden Fees and Financial Exploitation: Complaints cite unexpected charges, such as marketing costs and administrative fees, which were allegedly buried in fine print.

- Agent Misclassification: Independent agents partnered with 72 Sold argue they were wrongly classified as contractors, denying them benefits and fair compensation.

This section unpacks each allegation, supported by plaintiff testimonies and legal filings, to reveal systemic issues within the company’s operations.

Impact on Homeowners and the Real Estate Market

The fallout from the 72 Sold lawsuit extends beyond the courtroom. Homeowners who relied on the platform for quick sales report significant financial and emotional distress, including lost equity, prolonged housing insecurity, and damaged credit scores. Meanwhile, real estate agents affiliated with 72 Sold describe strained professional reputations and income instability. On a macro level, the case has sparked debates about the ethics of “instant sale” models and their vulnerability to exploitation. This section explores how the lawsuit has eroded trust in tech-driven real estate solutions and prompted calls for stricter regulatory oversight to protect consumers.

Legal Proceedings and Defense Strategies

As of [current date], the 72 Sold lawsuit remains in the discovery phase, with both sides preparing for a potential trial. The plaintiffs’ legal team is gathering evidence, including internal company communications and client contracts, to demonstrate a pattern of misconduct. Meanwhile, 72 Sold’s defense hinges on disputing the scope of the allegations, arguing that client dissatisfaction stems from market volatility rather than corporate malfeasance. The company has also emphasized its efforts to improve transparency, such as revised contract terms and enhanced fee disclosures. This section analyzes the strengths and weaknesses of both legal strategies and predicts potential outcomes, including settlements or precedent-setting rulings.

Lessons for the Real Estate Industry

The 72 Sold lawsuit serves as a cautionary tale for real estate professionals and consumers alike. For startups, it underscores the dangers of overpromising results in competitive markets. Agents and brokers must prioritize clear communication and ethical practices to avoid similar pitfalls. Consumers, meanwhile, are reminded to scrutinize contracts, seek third-party legal advice, and verify platform claims through independent reviews. This section also discusses emerging trends, such as state legislatures proposing laws to regulate “instant sale” platforms and requiring standardized disclosures.

Conclusion

The 72 Sold lawsuit is more than a legal battle—it’s a wake-up call for the real estate industry to balance innovation with accountability. As the case unfolds, its ramifications will likely influence how tech-driven platforms operate, how agents engage with clients, and how regulators safeguard consumer interests. Whether 72 Sold can rehabilitate its reputation or will become a case study in corporate missteps remains to be seen. What is clear, however, is that transparency, ethical marketing, and client-centric practices are non-negotiable in building trust in an increasingly digital marketplace.

Frequently Asked Questions (FAQs)

1. What is the 72 Sold lawsuit about?

The lawsuit alleges deceptive marketing, breach of contract, hidden fees, and agent misclassification by the real estate platform 72 Sold. Homeowners and agents claim financial harm due to unmet promises.

2. How does the lawsuit affect homeowners who used 72 Sold?

Homeowners report lost income, delayed sales, and unexpected costs. Many are seeking compensation for financial losses or released from contracts they deem unfair.

3. What is the current status of the lawsuit?

The case is ongoing, with both sides exchanging evidence. A trial date has not yet been set, though settlement discussions may occur as proceedings advance.

4. Could 72 Sold face penalties beyond financial compensation?

Yes. If found liable, the company could face fines, mandated operational changes, or restrictions on its business practices. Regulatory bodies may also launch independent investigations.

5. What should consumers consider before using instant sale platforms?

Research the company’s track record, read contracts carefully, and consult a real estate attorney. Be wary of guarantees that seem too good to be true.

6. How can real estate agents avoid similar issues?

Agents should vet partnerships thoroughly, ensure clear contractual terms, and maintain transparent communication with clients about risks and rewards.