The digital world today might be very restrictive for business in the traditional sense and may demand a lot of flexibility and international reach from growing businesses. That is precisely what Revolut Business was designed for. This service allows for a fully digital-first approach to business banking, with streamlined features and competitive pricing. Below, we break down its standout features, and why it is a top choice for many modern companies.

What is Revolut Business, and Why It’s Changing the Game

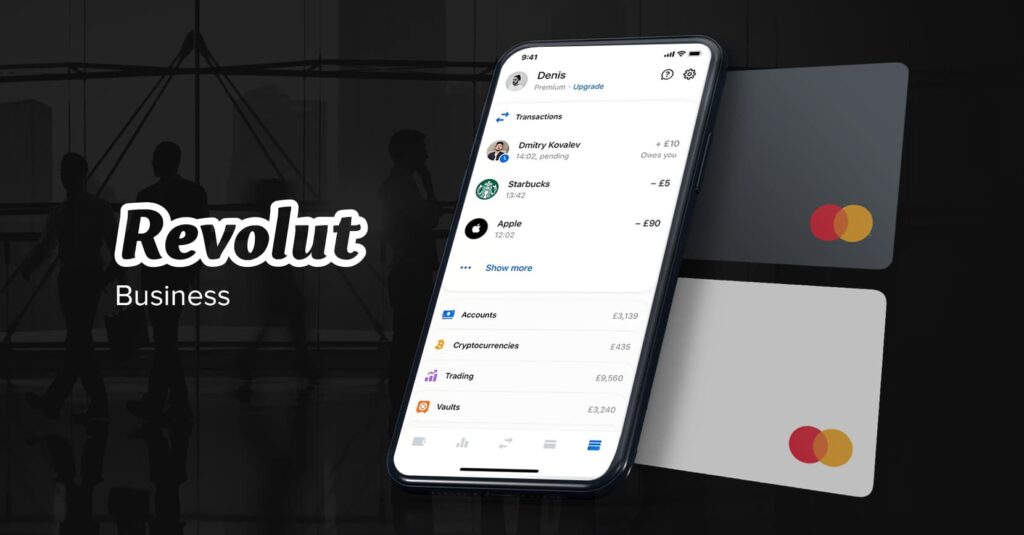

Digital banking that has been developed to accommodate businesses in the management of finances in an efficient cost-effective manner. Unlike standard banks, Revolut business provides a smooth, all-under-one-roof platform whereby expense management, multi currency accounts, and streamlined cross-border payments are accessible and can be accessed through just one application.

Main benefits of Revolut Business:

- Low fees: You never have to worry about domestic as well as international transactions paying low or no fees.

- Quick Payments: Make instant, cross-border payments at the best rate without all the hassle of traditional banks.

- Integrations: Integration with popular accounting software that makes your financial management smoother.

- User-Friendly Interface: Manage everything from the sleek, intuitive interface of the app.

Setting Up a Revolut Business Account

Accounts can easily be opened for entrepreneurs and small businesses. This makes Revolut an excellent option for freelancers, SMEs, and international companies since it is striving to simplify business banking.

Why Choose a Revolut Business Account?

Provides businesses with an edge over traditional banks through the delivery of key services which enhance efficiency:

- Streamlined Onboarding: No requirement to visit a physical branch as boasts extremely fast digital onboarding

- Competitive Features: There is real-time expense tracking, multi-currency accounts, and many more like this that modern business requires from Revolut.

- Integration with Accounting Tools: Xero, QuickBooks, as well as many others in the category

Who is Revolut Business Best For?

- Freelance and Entrepreneurs – ideal for self-employed persons and other individuals who are entrepreneurs in their own right since they require a flexible as well as affordable banking service.

- Small and Medium Enterprises: Best suited for SMEs which need fast and easy cross-border payment facilities along with expense management capabilities.

- Multi-Currency Companies: Best suited for companies dealing in multi currency transactions. The facility of global transfers is very efficient and cost-effective.

Step-by-Step Guide to Opening a Revolut Business Account

It’s free and easy to apply for aaccount completely online. Here’s the quick guide on how to sign up.

How to Sign Up

- Download the Revolut App: Start by downloading the Revolut app, available on iOS and Android.

- Choose Business Account: Select the business account option to begin the setup.

- Submit Details: Provide essential information about your business, including registration documents for verification.

- Verify and Access: Once approved, you can log in and start using your R,B account.

Revolut Business Login Tips

Here’s how one should log in onto their accounts via the following suggestions on login Revolut Business login

- Enable two-factor authentication: This adds another layer of security to your account.

- Control Multiple Devices: Link devices to your account for easy access on the go.

- Login Troubleshooting: Problems can be sent directly to Revolut through the app.

Account Tiers

Revolut has several account options, which range from free to paid accounts. Each tier offers several benefits, so businesses may choose a plan that best meets their needs and budget.

Important Features of Revolut Business Banking

Powerful features that enhance the banking experience. Some of the most valuable tools offered by Revolut Business are as follows:

Multi-currency accounts

You can hold, send, and receive payments in more than 30 currencies with a Revolut Business account. This will be very helpful for companies that need to operate around the world without high fees for exchange.

International Payments

, you can actually make instant, low-cost cross-border payments in multiple currencies. Competitive exchange rates for any business with international reach.

Strong Expense Management Tools

In expense management, offers a comprehensive range of tools-including real-time tracking, team budgets, and reimbursement management-so that you can streamline your expense process and have easy tracking control over your spending.

Integration with Accounting Software

Revolut Business connects seamlessly with popular accounting products such as Xero and QuickBooks. Such integration really smoothes your financial reports as well as account handling.

Accurate Reporting

At a detailed level, from within Revolut, you will get deep insights on cash inflows and outflows; a comprehensive look at a firm’s spending and costs versus budgets. The owner could finally make some informed financial decision for improvement of strategies to meet future financial flows needs.

Revolut Business Account UK – What UK Companies Need to Know

Has a host of unique benefits for UK businesses, particularly with respect to compliance and integration into UK banking standards.

Unique Advantages for UK Businesses

- FCA-Regulated: The company is registered with the Financial Conduct Authority. This ensures more protection to customers who are based in the UK.

- GBP Accounts and Local Payment Support: The business accounts allow you to hold a GBP account and make payments locally.

- UK-Focused Tax Tools: It also makes VAT returns, payroll, and other regulatory compliances very easy.

How UK Businesses Use Revolut Business Accounts

Many UK-based freelancers, small businesses, and larger enterprises are now using Revolut Business accounts to manage their finances better. They take advantage of Revolut’s cost-effective approach and powerful features.

Fees and Pricing for Revolut Business Accounts

Provides several pricing plans to be accessible to businesses of various sizes and needs.

Free vs. Paid Plans

Provides a free plan that has all the basic features of banking, and some paid plans provide higher limits on transactions, more members in the team, and more advanced tools. Choose a plan that is best according to your budget and your business needs.

International Transfer Fees

Revolut Business charges very competitive exchange rates on international transactions and fees are much lower compared to traditional banks’ charges.

ATM Withdrawals and Currency Exchange Fees

Even though the fees with Revolut Business are so low, some charges on ATM and foreign currency conversions are actually dependent on which plan you’ve chosen.

Pros and Cons of Revolut Business Banking

Review the advantages and disadvantages just before joining them.

Pros

- Low Charges: This offers you reduced transactional fees and best exchange rates.

- International Reaching : Perfect for companies frequently dealing in cross-border transactions.

- Easy Integrations: Connects to popular accountancy platforms for smoother financial working.

- Simple Interface: Operates accounts easily through a mobile application.

Cons

- Lack of Physical Support: Revolut is a digital-only bank and does not have branches.

- Risk of Freezing: Some users’ accounts experience freezing due to security, thereby disrupting business activities.

- Small Credit Line: Revolut Business is not perfect for businesses that require significant amounts of credit.

Frequently Asked Questions?

Is Revolut Business Safe?

Yes, is safe and regulated by the FCA in the UK and has robust security features with encryption to protect your data.

Can I Open a Revolut Business Account Outside the UK?

Accounts are available in several countries, with expansion plans. Check the app or website for current availability.

How Do I Contact Revolut Business Support?

For prompt help, one can access support directly from the app, via an email ticket, or as a live chat.

Conclusion:

Revolut Business is the perfect choice for companies that need an easy and inexpensive alternative to traditional banks. It is particularly ideal for freelancers, SMEs, and global businesses, as they have to deal with cross-border payments and expenses effectively. If your business requires streamlined, tech-savvy banking, BRITAImay be just the thing for you.